This article is part of the “CORT Workplace Talk” series where Melanie Jones, CORT’s National Director, CRE Partnerships, sits down with thought leaders in commercial real estate to discuss advancements, insights, and trends within the industry. Sit back and learn more about CRE and how CORT Furniture Rental can benefit your organization.

I recently read this terrific article entitled, “Square foot in a round hole? Why office space may need a new valuation model”, published by Business Reporter. For example, “Much is made of hybrid working, but there are already signs that the future will be more than a binary choice between two desks. Instead, we believe that businesses will increasingly need to adopt a dynamic model – one that rewards people with the freedom and choice to operate at their best and be at their happiest.”

The timing feels spot-on to share an interview with one of CORT’s newest clients, Edison Spaces, not only serving the growing flex office community but doing so in US mid-markets. A pioneer who is colliding with perfect timing! Enjoy.

David Heyburn, Managing Director, and Jessica Renfrew, Director of Operations, join us to discuss their flexible space offering, Edison Spaces.

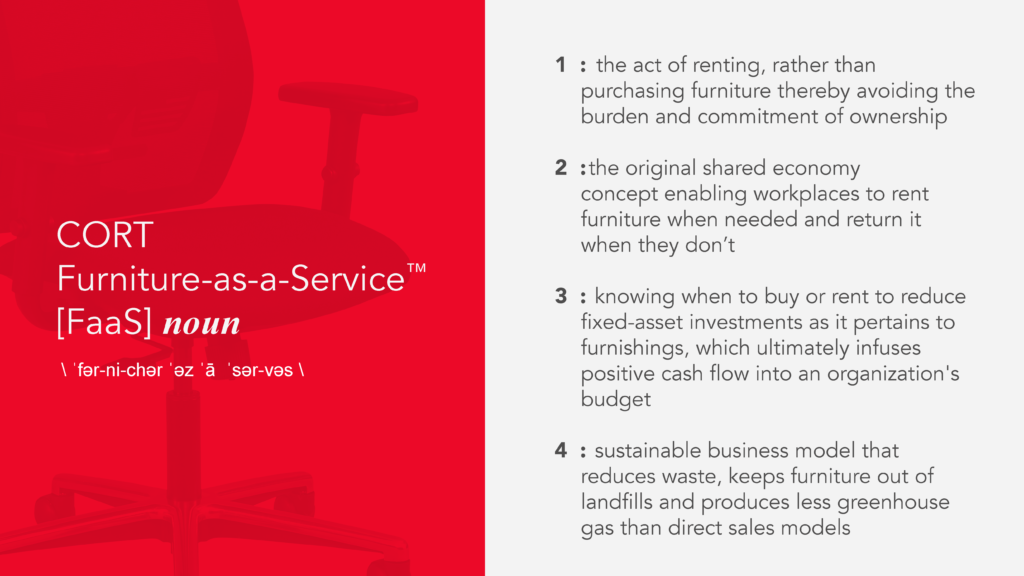

Special thanks to Christina Meyer, Director of Strategic Business Development for CORT, for helping the Edison Spaces team achieve their objective of staying asset-light, reducing capital, and providing future clients with true flexibility leveraging the CORT Furniture-as-a-Service™ offering!

MJ: Tell me about the Edison Spaces model and what inspired you to develop and launch the concept?

ES: Edison Spaces was founded by two midwestern entrepreneurs looking for an office for a couple of their small startups but couldn’t find anything in the market that fit their ever-changing needs.

We set out to build Edison Spaces to solve a problem faced by any entity in need of office space for a small group. Searching for space and executing a commercial real estate lease has always been the same process whether the need is for four people or 400 people, 100 square feet, or 100,000 square feet. We saw that the market was fundamentally broken for a large segment of the business and startup community and believed that getting an office shouldn’t be a barrier to building a business.

Many small businesses and growing startups don’t know what life will look like in five months, let alone five years, so why take on the risk of a multi-year lease contract?

Conventional leases rigidly define your space, preventing agility as your business needs change. Then, of course, the cumbersome tasks of procuring furnishings, setting up and managing all of the IT needs, and managing all of the various service vendors to keep the place running. All of this hassle amounts to, at minimum, a major distraction for a small business or startup working to successfully build their core business, ship their core product, or invest in innovation.

We asked, what if space was flexible, configurable, affordable, and fully ready when someone needed it? And that was the beginning of our mission.

MJ: I know you are interested in serving mid-markets. What kind of research have you conducted in these markets?

ES: We started with the markets that we know from living and working in them; we’re mid-westerners first and know that mid-tier market cities have robust economies that demand a variety of office types, but rarely get the media attention of coastal urban-gateway cities. In addition, the mix of small businesses and startups in these cities experience dynamic growth and need flexible office solutions that can be agile with them as their companies evolve. Finally, we believe there’s an under-supplied market of companies and decision-makers in mid-tier suburban areas that need access to modern office space without the hassle of getting an office.

Our learnings resulted from conversations with customers, brokers, and landlords. Suburban environments tend to be more traditional or conservative areas; the office industry, which has been slow to innovate, is also more conventional and conservative in their office products. There is an undersupply of flexible offices in strong mid-tier market suburban areas. Our goal is to be an early mover in this space to help customers find flexible space and landlords looking to bring a Space-as-a-Service offering into the asset.

Additionally, some industry reports track North American Flexible Office markets, which help inform us about which markets have economic makeup that supports the need for flexible offices.

MJ: What trends are you seeing or forecasting in these markets? Hub/Spoke. Core/Flex.

ES: Over the last 15+ years, there has been a trend towards re-urbanization in mid-tier markets like Kansas City. More apartment units and businesses are coming to revitalized urban centers to be a part of that renaissance. COVID has significantly altered this trend trajectory, at minimum softening demand for office space in the urban core. The majority of professionals who have the authority to make office location decisions reside in 1st, 2nd ring suburbs and would prefer to work closer to home, cutting out the commute. We think COVID has accelerated the trend of more and more people orienting within a 15-minute radius from their home, which supports having office options closer to where most people live.

Our primary customer segment is entrepreneurial small businesses and startups, with satellite or departmental divisions of larger companies as a secondary customer segment. So we see the demand for primary office space for these customer segments softening in urban central business districts while strengthening in suburban town centers combining livability with accessibility.

MJ: How receptive are landlords to your offering?

ES: Receptive & curious but often hand-tied by lender requirements within capital markets for tenant improvements.

They see the problem that we’re trying to solve by having shorter-term/flexible office space within their building/portfolio, BUT industry norms prevent it from coming to life. At least for now.

The landlords may be interested in flexible office use-case, but financing options have not kept pace with the growth of what some call perhaps a future asset class.

MJ: What kind of structure are you using? Joint Venture, Shared Revenue, Management Agreement?

ES: Edison Spaces operates under Management Service Agreements that include sharing revenue with investors such as landlords and developers. Our current and future locations will be branded as Edison Spaces to create a consistent brand and experience. We see value there.

MJ: You promote the concept of flex offices rather than coworking. What’s your strategy?

ES: Our customer segmentation is that of small entrepreneurial businesses, startups, or divisions of larger companies with a greater focus on private offices and the ability to block out some of the distractions that come with a social-club-like atmosphere.

In short, for our client base, our view is simple. Coworking = chaos, and private offices = productivity.

MJ: Why did you initially reach out to CORT and our Furniture-as-a-Service™ offering?

ES: We learned about access to CORT’s tremendous inventory and selections, appreciate the national scale and reputation that comes with working with a Berkshire Hathaway company.

MJ: We appreciate that. Our business is a bit tricky. A tremendous amount of work goes into product selection, global purchasing, asset management, distribution, logistics, and the operational expertise to service some of the largest occupiers in the US to a business needing a few pieces of furniture!

How are you strategically using our Furniture-as-a-Service™ model – focused on access rather than ownership?

ES: One of our initial goals is to reduce capital costs during the opening of new locations. Partnering with CORT and the Furniture-as-a-Service™ model, we dramatically reduce our upfront capital expenses and don’t have to carry debt. Instead, we can provide furniture on-demand and deliver furniture as spaces are rented and provide the furniture configuration our new customer actually prefers.

MJ: What other kinds of partnerships are you leveraging as expansion occurs?

ES: We are considering what partnerships we’d like to leverage; we are trying to build our operations model from a digital-first customer experience. We recognize our product is inherently a physical product, so leveraging partnerships that allow us to provide physical support, when necessary, without carrying the personnel expense over the long term is critical.

MJ: Within our network, there is a significant focus on the Space-as-a-Service conversation. You are a fan of serving up an environment that falls into this category. In fact, you have incorporated a good bit of technology to enhance the user experience. Tell me about that.

ES: There’s so much fluidity in business these days. They say the average college grad may change jobs 11 times in their career, a far cry from the lifelong tenure of our parents and grandparents. That speaks to the fact that companies grow, scale quickly, sell, merge, close – all much more rapidly than in years past.

So, companies need to focus on building their core business, not fussing with their real-estate contracts and vendors to service it. In addition, more and more businesses are demanding a move-in-ready solution with the flexibility to change their office space needs as their business needs evolve.

MJ: We too see the tremendous desire for flexibility. How we consume so many products and services has changed. Our subscription economy world makes it easy, in many cases, to simply access what we need, when we need it. From clothing, technology, entertainment, offices, and of course, furniture!

MJ: Aside from COVID, what are the biggest challenges you face short-term and long-term?

ES: Everyone’s trying to look into the crystal ball to determine what the “workplace of the future” will look like and the long-term effects of work-from-home vs. in-office work, and what hybrid/flexible strategies will sustain in the long term run.

MJ: I agree! We are amid massive disruption in commercial real estate. What excites you the most?

ES: The shift from being a commercial-centric industry to a consumer-centric sector is top of the list. It’s the reason we launched 6 years ago in the first place.

The internet and digital technology create consumer access to information to purchase goods and services in transformative ways. Most industries have tapped into this much more so than commercial real estate.

Commercial real estate has continued to operate much as it has for the past 30+ years; however, some major flagship operators have created a crack in the dam that will only continue to expand. What that exactly looks like is unknown, but exciting to be a part of it all!

About David

David Heyburn is Managing Director for Edison Spaces, responsible for organizational development including growth and expansion through new partnership models as well as optimizing business operations and performance. Prior to his role at Edison Spaces, he launched and led the Kansas City market for an international flagship flexible-office and coworking operator. His prior experience includes community planning & economic development, creative placemaking, consumer banking, residential real estate.

About Jessica

Jessica Renfrew is the Director of Operations for Edison Spaces, responsible for sales, marketing, customer relationships and site operations. Jessica has experience managing multiple entrepreneurial ventures, with prior experience in residential and commercial real estate. She is passionate about the growth and success of Mid-Western businesses and communities.

About Melanie

Melanie Jones is responsible for educating, supporting, and building relationships with commercial real estate teams across the US in support of CORT’s Furniture-as-a-Service™ model. A mission-driven leader who brings the necessary energy and innovation to support change in the way furniture is utilized in buildings and the workplace.

About Christina

Christina Meyer is a National Director of Strategic Business Development for CORT with 25 years of experience providing innovative FaaS solutions that align business objectives with results.