Written by: Melanie Jones

Most agree that flexible space is no longer the stepchild of commercial real estate. As an emerging asset class, the question is no longer, “should flexible space be provided in most buildings” it’s now merely a matter of when, where, and how. Many landlords are deep in the discovery process as they figure out where flexible space will exist to support evolving strategies and answer the demand.

Recently I had a conversation with Lawrence Gellerstedt. I truly value his thoughts since he was a leader at both Cushman & Wakefield and WeWork before launching his firm Southsource Advisors in Atlanta.

In the chat, he states, “On both the landlord and tenant side, we are counseling folks to challenge themselves to embrace the concept of flexibility. I think short term leases in office have historically been resisted. Still, COVID has forced an unprecedented acceleration of this demand from tenants, at the same time, undermining landlords’ leverage to resist.

I think in this cycle that the capital markets will buckle and finally allow for the underwriting of this product type. Hotels and apartments have been financeable for years on short term leases. The flexible office has more than proven to generate increased NOI in excess of what is necessary to adjust for cap rate increases and maintain value.

I also think we have to look beyond flexibility. WeWork proved that by bundling flexibility, amenities, and services, users were willing to pay more than the sum of the parts. It is vital that we now unbundle all this. We simply have to identify what users want, and at the same time, encourage landlords to expand their offering to maximize value creation on both sides.”

His comments are very relevant to our mission at CORT. We are supporting landlords working to provide flexible space for tenants.

The questions that continue to bubble up in our discovery sessions with landlords are along these lines:

- Do you want to be in the furniture business?

- Do you want to manage the furniture assets from one tenant to the next?

- Do you want to outlay cash when a more flexible financial option is available?

- Do you think permanent product belongs in a space positioned as flexible?

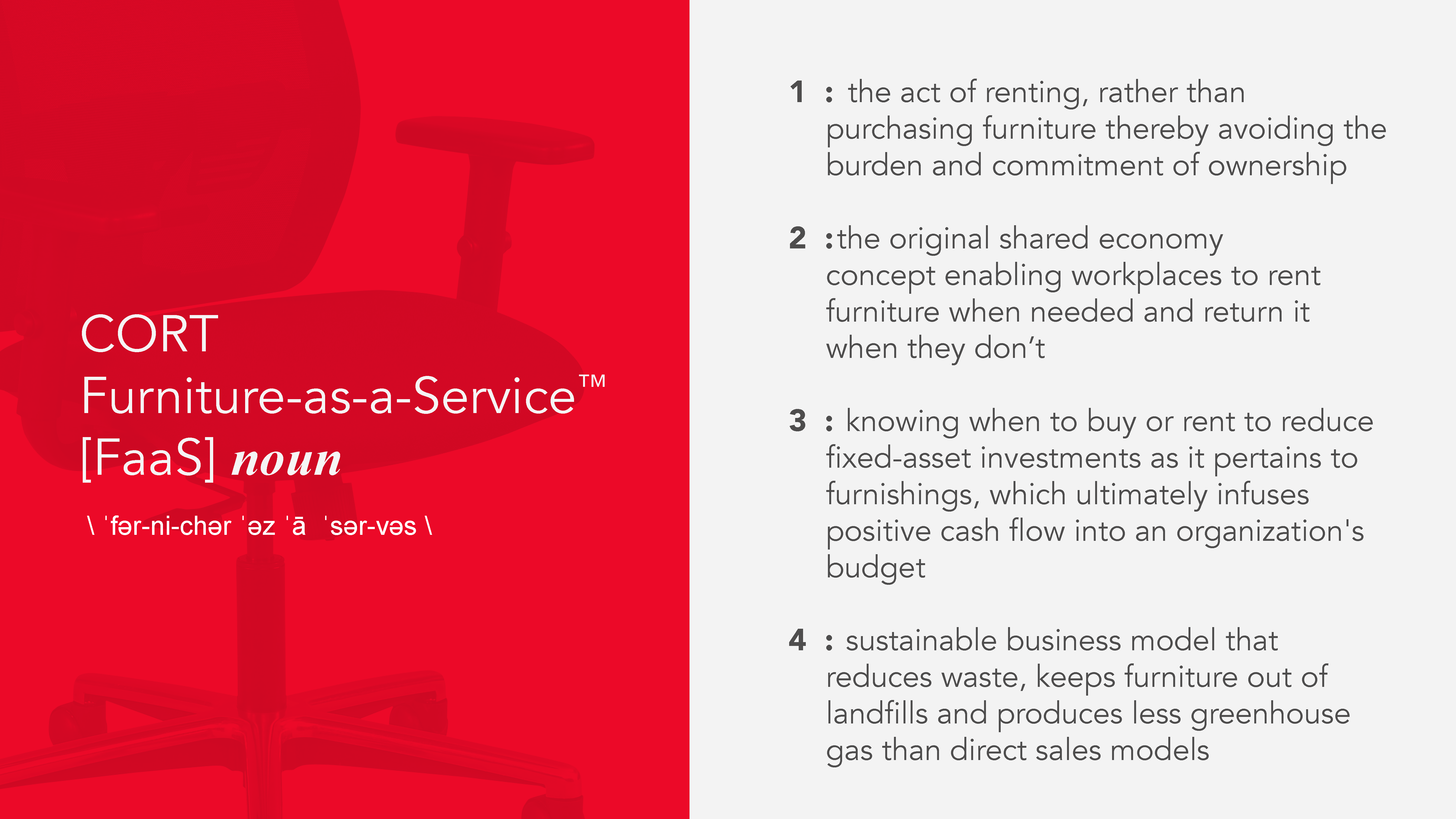

When landlords answer no to the above questions, CORT Furniture-as-a-Service™ (FaaS) model usually makes sense.

FaaS provides landlords and their tenants with access to furniture without the limitations of ownership. CORT, a Berkshire Hathaway company with an international footprint, owns many millions of dollars of furniture available to use.

I like to think of it as a subscription-like approach for the workplace; Subscribe to Furniture On Your Terms™. The furniture supports the need, whether it be for one month or multiple years, and as conditions change, so can the furniture.

We urge landlords to think outside the box when it comes to speculative suites and private flex. Early adopters are having tremendous success incorporating the FaaS model into their flex operating strategy. Like most new things, a bit of exploration is required. For example, there is a need to weigh tactics in structuring the offering. Is furniture incorporated into the flex office lease, with or without a margin? Or, perhaps a program is in a place where the tenant relationship is direct with CORT.

We see some extremely creative furniture packages being assembled as landlord design teams and CORT’s project planners collaborate in both cases. They can select products from the vast rental inventory available from the Tradeshow, Residential, and Workplace product lines. Developing set package options is one way to control the product’s look and feel going into shared spaces or creating a sense of continuity within assets.

Big news for landlords is the recent partnership between CORT and FastOffice. The alliance provides a powerful tool for landlords that quickly serves up 3D models and test fits and subscription-based marketing services to drive demand.

This digital interface can provide critical detailed information, sometimes within just a few minutes, to show interested tenants a potential occupancy plan that includes the speed and flexibility of CORT’s Furniture-as-a-Service™ approach. As data and speed continue to drive deals, landlords can tap into this offering and support the growing demand for short-term flexible space in their buildings.

Casey Myhre, Co-Founder, and COO of FastOffice, put it this way, “the data on our partner listing platforms shows us tenants are more likely to shortlist space that can be validated online versus in person. Not having a digital strategy is no longer an option. Flex is here to stay, and these tenants demand an online experience. As a matter of fact, according to JLL, 30% of all office space will be flexible in some way by 2030. Being able to turn over these types of spaces quickly and efficiently will be critical in maintaining target Cap rates”.

My colleague Ron Steinbrink shared feedback based on client conversations worth noting.

“The unbundling term is critical. By unbundling, the landlord has more control over the program. Unbundling requires more work for the landlord, but it also creates a revenue opportunity and increases the NOI.

Another benefit of unbundling it reduces the risk for the landlord. In the current market situation with WeWork, Spaces, and other operators filing bankruptcy, minimizing risk is a concern for landlords.

And of course, the other upside for landlords is that the new Flex tenant is potentially a long term tenant as their business needs change. As corporations start looking to rebalance their real estate portfolio, why would any landlord not want to be able to service all their needs?”

Even though we are still in a bit of a pause, I am confident we help clients prepare to Do More. Be More. Go Further. as our slogan says.

Moving out of these unusual times and adapting to accelerating trends and new solutions, we are nudged in the direction of flexibility and encouraged to embrace change. Not all bad!

Melanie Jones is the National Commercial Real Estate Business Development Manager at CORT. She is responsible for building awareness and sharing strategy with commercial real estate teams around access vs. ownership model called Furniture-as-a-Service. Follow Melanie on LinkedIn.

Photo by Startup Stock Photos from Pexels